Turkish Airlines is evaluating a bid for a minority stake in Air Europa, according to sources familiar with the process. The Turkish carrier has joined the list of companies eyeing a strategic investment in the Spanish airline. The deadline for binding offers is set for early July.

The news was first reported by the Spanish outlet El Español, marking another twist in a sale process that has been anything but straightforward.

A Lengthy Process with Internal Hurdles

The sale of Air Europa has faced multiple delays. Two sources confirmed that binding offers were originally expected in May. The holdups have been attributed to disagreements within the Hidalgo family—founders and current controllers of the airline through the Globalia Group—as well as concerns from potential buyers about the deal’s structure.

Currently, interested parties are working with advisors to craft bids that would allow them to acquire around 20% of the airline, with an eye toward eventually gaining full control. However, a fourth source noted uncertainty about how a majority stake could be secured later, raising doubts among some potential investors.

Fierce Competition: Lufthansa and Air France-KLM Also in the Race

Turkish Airlines is not alone in this pursuit. Air France-KLM and Lufthansa are also in talks with Globalia to acquire a stake in Air Europa, as reported by Reuters. An Air France-KLM spokesperson confirmed their interest in strengthening their long-standing cooperation with the Spanish airline. Lufthansa, meanwhile, declined to comment, as did representatives from Globalia and the Hidalgo family, who cited the confidentiality of the process.

The international interest in Air Europa is no coincidence. The airline operates domestic flights in Spain, as well as connections between Madrid and major cities in Europe and Latin America, making it a valuable asset for any group looking to expand its presence in Southern European routes.

Turkish Airlines and Air Europa: A Relationship That Could Deepen

Turkish Airlines already generates over a quarter of its revenue in Europe and has a codeshare agreement with Air Europa, which could facilitate potential integration or operational synergies. This existing relationship strengthens the logic behind the Turkish carrier’s possible move.

European Consolidation: A Strategic Necessity?

The European context is another key factor. Pressure to consolidate in the region is growing as airlines aim to compete with U.S. and Middle Eastern giants. Southern European routes, in particular, have become a priority for expansion.

The case of IAG (owner of British Airways, Iberia, Vueling, and Aer Lingus) is illustrative: the group already holds a 20% stake in Air Europa but abandoned its attempt to acquire the airline outright last year due to regulatory concerns about competition in the Spanish market. Today, that stake could also influence the outcome of this new phase in the process.

Turkish Airlines’ entry into the bidding for Air Europa not only adds complexity to the process but also raises questions about the future of aviation in Europe.

Related Topics

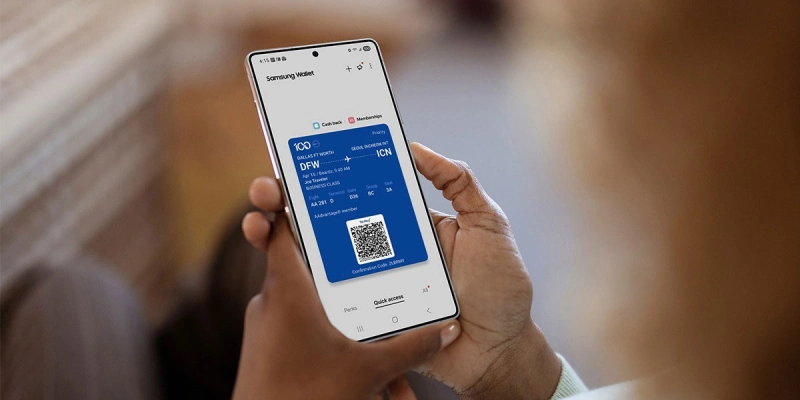

American Airlines Becomes First U.S. Airline to Integrate Boarding Passes into Samsung Wallet

FAA Proposes Flight Reductions at Chicago O’Hare to Avert Summer Operational Collapse

Qantas announces new route: Sydney and Las Vegas to be Connected for First Time via Direct Flights

FAA Issues Airworthiness Directive for Boeing 737 MAX Due to Risk of Excessive Cabin Temperatures

Plataforma Informativa de Aviación Comercial con 13 años de trayectoria.