Low-cost airline Ryanair reported on Monday a net profit of €2.54 billion for the first half of its fiscal year (April-September). This represents a 42% increase compared to the same period in 2024, when it earned €1.79 billion. This performance was driven by an increase in passenger traffic and an improvement in average fares.

Easter and Higher Fares Boost Revenue

According to the company’s statement, the timing of the Easter holiday played a key role in the financial performance, as it fell entirely within the first fiscal quarter (April-June). This factor contributed to a 3% growth in traffic, reaching 119 million passengers. Furthermore, the average airfare price rose from €52 to €58.

Turnover and Revenue Per Passenger

During the half-year, Ryanair’s total revenue amounted to €9.82 billion, marking a 13% increase. Revenue per passenger also showed positive evolution, growing by 9%. In parallel, ancillary revenue—which includes services such as priority boarding and onboard consumption—increased by 6%, reaching €2.91 billion. These revenues account for approximately 25% of the airline’s total turnover.

→ Ryanair Announces Record Winter Schedule in Amman (Jordan)

Fare Recovery and Operational Efficiency

Michael O’Leary, CEO of Ryanair, highlighted that the company achieved a “full recovery” of the 7% decline in ticket prices recorded in the second quarter of the previous year. He also emphasized the “strong control” over operational costs per passenger, which “rose by only 1%.” Savings derived from fuel hedging helped offset increased costs from air traffic control charges and environmental requirements.

Projections for Fiscal Year-End

Looking ahead to the close of the fiscal year, O’Leary estimated that Ryanair’s traffic will grow “by more than 3%,” reaching 207 million passengers. This increase is partly attributed to the early delivery of Boeing aircraft and the “strong demand” recorded in the first half.

Although the executive considered it premature to provide a “meaningful forecast” for the full year, he expressed confidence in fully recovering the previous year’s decline in airfare prices. This should translate into “reasonable net profit growth in fiscal year 2026.”

External Risks That Could Affect Performance

O’Leary warned that the final result is exposed to adverse external factors, such as the escalation of conflicts in Ukraine and the Middle East, macroeconomic crises, and the impact of repeated strikes and poor management by European air traffic controllers.

Related Topics

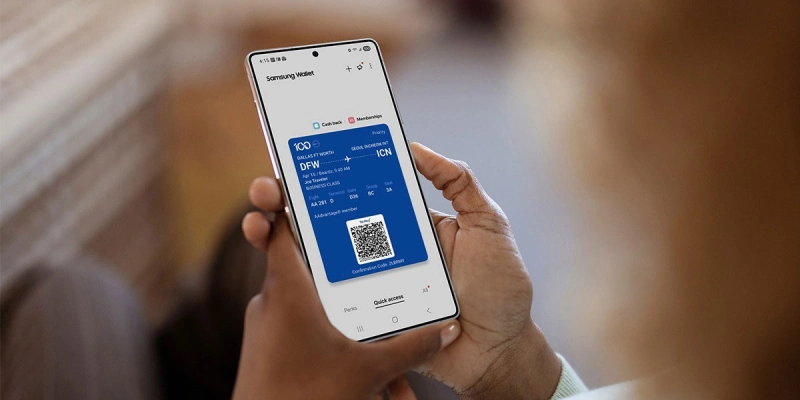

American Airlines Becomes First U.S. Airline to Integrate Boarding Passes into Samsung Wallet

FAA Proposes Flight Reductions at Chicago O’Hare to Avert Summer Operational Collapse

Qantas announces new route: Sydney and Las Vegas to be Connected for First Time via Direct Flights

FAA Issues Airworthiness Directive for Boeing 737 MAX Due to Risk of Excessive Cabin Temperatures

Un apasionado por la aviación, Fundador y CEO de Aviación al Día.