GOL Linhas Aéreas Inteligentes, one of Brazil’s leading airlines, has received approval from the U.S. Bankruptcy Court for its Chapter 11 Reorganization Plan, marking a key milestone in its restructuring process, which is projected to conclude by early June 2025. With this legal endorsement, the company is poised to emerge financially stronger and operationally more efficient.

Solid Financing and Strategic Agreements

During the process, GOL secured US$1 billion in debtor-in-possession (DIP) financing, which strengthened its liquidity and allowed it to reinvest in its fleet. In addition, it agreed concessions with lessors totaling US$1.1 billion, covering its entire existing fleet. These concessions not only helped to pay off accumulated maintenance, but will generate permanent savings in rentals and end-of-lease obligations.

The support of Brazilian financial institutions was also crucial: approximately US$150 million in local debentures were restructured and some US$340 million was accessed through accounts receivable factoring, a vital resource for the liquidity of Brazilian companies.

Benefit Improvement Program and Key Support

As part of its reorganization, GOL activated a US$181 million annual profit improvement program, which will position it as one of the most cost-competitive airlines in South America. In parallel, it reached a Plan Support Agreement with Abra Group Limited and the Unsecured Creditors Committee, which will allow for a reduction of up to US$1.6 billion in pre-process funded debt and up to an additional US$800 million in other obligations.

→ GOL Reinstates Direct Route Between Porto Alegre and Buenos Aires After 9 Years

It also reached an agreement with Brazilian authorities to reduce unpaid taxes and other contingencies for close to US$750 million, in addition to generating US$184 million in liquidity through 2029.

Boeing, a Partner in Recovery

In collaboration with Boeing, GOL modified its purchase contracts, obtaining concessions of US$262 million and incremental liquidity through 2029. The total financial relief from this agreement exceeds US$700 million, representing a significant part of its turnaround strategy.

Furthermore, the airline secured $1.9 billion in exit financing, which will cover the DIP financing maturity upon emergence and provide additional funds to execute its business plan.

A Renewed and More Profitable Fleet

GOL overhauled more than 50 engines in 2024 and plans to have its entire fleet operational by the first quarter of 2026. In 2025, it will receive five new Boeing 737 MAX aircraft, supporting its return to pre-pandemic domestic capacity.

The company has also shown positive financial trends: in the fourth quarter of 2024 and the first quarter of 2025, it exceeded financial targets, with recurring EBITDA growing 17.4% year-over-year and net revenue increasing 19.4% in the first quarter.

What’s Next: Final Approval and Equity Restructuring

With the plan now confirmed, the next step is the shareholders’ meeting on May 30, 2025, where the proposed capital increase will be voted on. Following implementation, Abra will remain the primary indirect shareholder.

Under the terms of the plan, GOL will significantly reduce its debt by converting up to US$1.6 billion of pre-process debt and another US$850 million in additional debentures into or canceling shares. This conversion will generate a significant dilution of existing shares, while respecting shareholders’ preferential rights under Brazilian law.

With a stronger financial structure, a renewed fleet, and a clear strategy, GOL is ready to soar again and lead the South American aviation market in the coming years.

Related Topics

Condor Lands in Haikou: German Airline Strengthens Commitment to Chinese Market

Air India Inaugurates its First Maharaja Lounge at New Delhi Airport

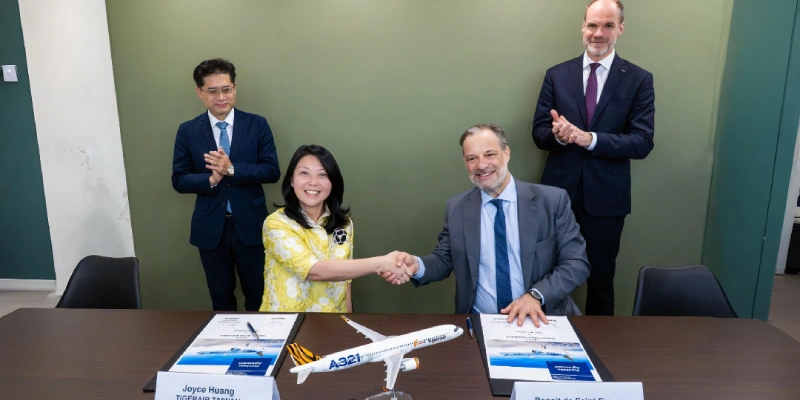

Tigerair Taiwan Bets on the A321neo, Redefining Regional Growth Strategy

Air Cambodia Makes Leap to 737 MAX: Historic Order For up to 20 737-8 Jets Marks a New Era For the Airline

Plataforma Informativa de Aviación Comercial con 13 años de trayectoria.