Steven Greenway, CEO of Saudi low-cost carrier Flyadeal, issued a sharp critique of Airbus for persistent delays in narrow-body aircraft deliveries and expressed concern that the issues could extend to the newly ordered A330neos.

The remarks were made on the sidelines of the International Air Transport Association (IATA) summit in New Delhi, just weeks after Flyadeal announced an order for 10 A330neos. The airline, a subsidiary of Saudia, operates in an increasingly competitive market where precise planning is critical.

Patience Wearing Thin

Greenway was blunt: “The delays are becoming inexcusable. Transparency, frankly, is nonexistent, and we’re losing patience. How are we supposed to plan like this? It’s a joke at this point.”

The executive revealed that the airline currently has two aircraft grounded in Toulouse with no resolution in sight. “We were scheduled to receive four aircraft in the first half of the year. Only two arrived, and they were late,” he explained. According to his timeline, one A320neo is due in the third quarter and three more in the fourth. But Greenway is skeptical: “I highly doubt those three will actually arrive.”

→ Vietjet Doubles Down on A330neo: Orders 20 Additional Aircraft from Airbus

Supply Chains Under Pressure

Flyadeal is not alone in facing these challenges. Engine supply issues from CFM, a joint venture between Safran and GE Aerospace, have created bottlenecks in Airbus’s assembly line. Safran stated in April that the supply chain was showing signs of recovery, but Greenway remains unconvinced.

“We’re talking about an industry hit hard by mass worker exits after COVID-19. But to still be in this situation three or four years later is inexcusable,” the CEO emphasized.

Trouble Ahead for A330neos?

An additional concern for Flyadeal is whether the same delays will plague its newly ordered A330neos. While there are no reports of delays for this model yet, Greenway is cautious: “Our first aircraft is supposed to enter the final production line in December next year. I don’t know if that will actually happen.”

Reuters recently reported that Airbus had warned airlines that this pattern of delays could persist for at least three more years. Aircraft lessors have also flagged potential supply tightness until the end of the decade.

Operational Impact and Stopgap Solutions

The uncertainty complicates key decisions such as pilot training, crew allocation, and new route launches. “You can’t plan anything,” Greenway insisted. To avoid disruptions, Flyadeal has resorted to temporary solutions like wet leasing.

During July and August—peak season for the Saudi market—Flyadeal will operate two wet-leased A320s with crew from Philippine low-cost carrier Cebu Pacific. This measure is necessary to fill operational gaps caused by the missed deliveries.

Airbus Remains Silent

Airbus has not commented on the narrow-body delays, though it previously stated that its target of 820 annual deliveries remains on track and that it is working to mitigate the impact on customers. Regarding the A330neo, the manufacturer claimed there are no reports of delays.

Meanwhile, tensions are rising among key industry players. Greenway’s remarks reflect widespread frustration among airline executives at the IATA annual meeting.

Flyadeal is demanding clear answers and concrete solutions. In a demanding post-pandemic environment, the patience of airlines appears to be wearing thin.

Related Topics

Condor Lands in Haikou: German Airline Strengthens Commitment to Chinese Market

Air India Inaugurates its First Maharaja Lounge at New Delhi Airport

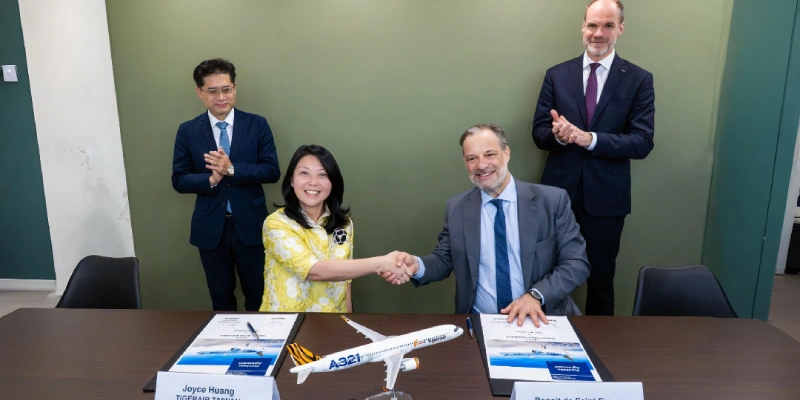

Tigerair Taiwan Bets on the A321neo, Redefining Regional Growth Strategy

Air Cambodia Makes Leap to 737 MAX: Historic Order For up to 20 737-8 Jets Marks a New Era For the Airline

Plataforma Informativa de Aviación Comercial con 13 años de trayectoria.